Continuous Monitoring

Secure your workplace by automating continuous monitoring checks on your employees.

Hire professional employment screening services to stay updated with your employees’ unlawful activities or unethical practices and protect, preserve, and guard your organization.

What is continuous monitoring?

Pre-employment screening and background checks sustain a healthy and secure environment in the workplace. Human Resource teams reach out to regulatory bodies and several educational institutions to validate the claims of prospective candidates before hiring. However, these pre-employment background checks become outdated over time. Even annual background checks limit the precise clarity of an employee’s behavior.

Continuous monitoring offers reliable checks on employees to monitor any change in their criminal record. These checks utilize criminal databases, trial records, and registry searches to locate any suspicious activity your employee indulged in allowing you to determine if an employee is a threat to your organization.

Why is continuous monitoring important?

Many employers have resorted to taking assistance from background check companies to implement automated recurring checks on employees. The continuous background check for employment plays a vital role in disclosing unidentified threats in your organization.

- Maintains compliance with government regulations

- Prevent fraudulent activities and identity theft in the organization

- Regular checks on employees keep you updated with their records

- Help the HR teams in making the correct decisions and protect your brand name

- Safeguards your workforce and increases workplace productivity

- Timely disclosure of an offense allows you to make the right decision and save the company from bad publicity

Legal compliances

Constant monitoring is crucial in organizations. It helps in incorporating correct strategies on time to eliminate any risk. However, you cannot simply execute continuous screening of your employees. Several laws and acts lay down the approach and guidelines you must follow. cFIRST adheres to these regulations and compliances throughout the process.

The Indian Contract Act establishes the obligations, rights, and duties of two contracting parties. It works on the fundamental concepts of English common law defining the conditions under which both parties’ commitments to a contract are legally binding.

The Indian Penal Code (IPC) is the country’s primary criminal code. It includes any illegal or illicit wrongdoing, such as state or public tranquillity crimes, felonies against a human body or property, conspiracy, and so on. The Indian Penal Code recognizes the guilty and defines the punitive measures.

The purpose of the Information Technology Act is to protect all digital transactions. It provides legal protection for information and communication transmitted via electronic means. The Information Technology (Reasonable Security Practices and Procedures and Sensitive Personal Data or Information) Rules, 2011, govern the acquisition of data or anything that validates an individual’s identity and sensitive personal data, such as financial information, medical records, and so on.

The Credit Information Companies (Regulation) Act of 2005 asserts rules and regulations for Credit Information Companies (CICs). It facilitates efficient credit distribution and oversees the process. It is an intricate measure of legislation with several provisions.

The Indian Contract Act establishes the obligations, rights, and duties of two contracting parties. It works on the fundamental concepts of English common law defining the conditions under which both parties’ commitments to a contract are legally binding.

The Indian Penal Code (IPC) is the country’s primary criminal code. It includes any illegal or illicit wrongdoing, such as state or public tranquillity crimes, felonies against a human body or property, conspiracy, and so on. The Indian Penal Code recognizes the guilty and defines the punitive measures.

The purpose of the Information Technology Act is to protect all digital transactions. It provides legal protection for information and communication transmitted via electronic means. The Information Technology (Reasonable Security Practices and Procedures and Sensitive Personal Data or Information) Rules, 2011, govern the acquisition of data or anything that validates an individual’s identity and sensitive personal data, such as financial information, medical records, and so on.

The Credit Information Companies (Regulation) Act of 2005 asserts rules and regulations for Credit Information Companies (CICs). It facilitates efficient credit distribution and oversees the process. It is an intricate measure of legislation with several provisions.

Why screen with cFIRST?

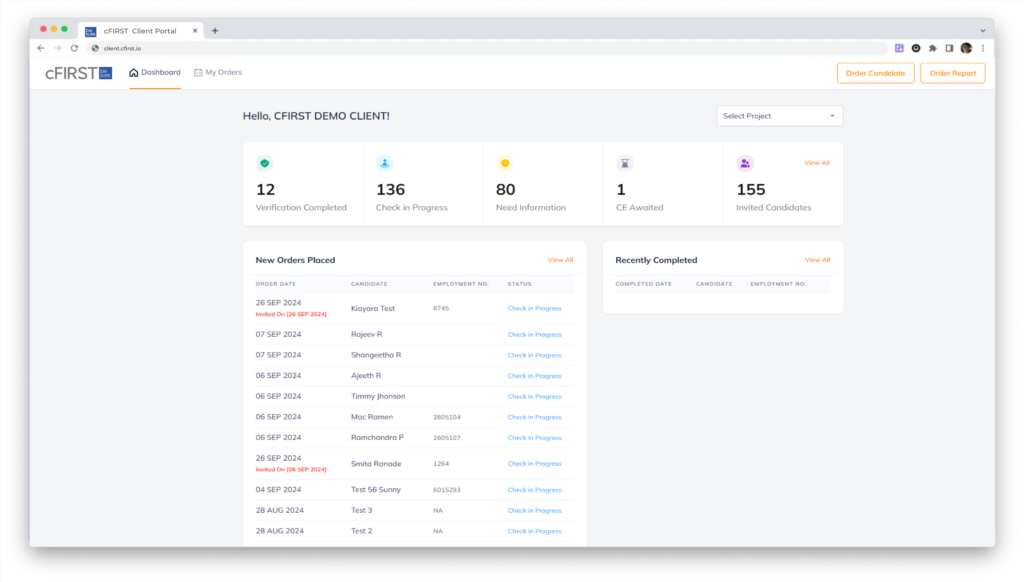

As one of the optimal background checks companies, cFIRST provides diligent continuous monitoring services to alert you every time your employees break or breach a law. You will receive real-time notifications when an employee is charged, arrested, or booked by a court. cFIRST helps through

- Straightforward and convenient process with quick results

- Reliable, accurate, and authentic real-time results

- Automated continuous screening services while complying with all the jurisdictions

- Notifications and alerts with a fast turnaround time to make you aware of your employees' criminal records

- Industry experts with vertical support to suit specific business requirements

- Readily available, accessible, and scalable continuous monitoring services with a seamless experience